The above chart shows the top users of electricity in a typical US home. The data are from the EIA and date from 2001 so it might have changed a bit but probably not all that much. Note that this is only electricity usage, not all energy usage.So if you want to conserve, you can see where are the likely highest priority places to start. Of course, these are national averages so you can make regional or personal adjustments. For example, if you live in the southern parts of the US, air conditioning is likely a bigger fraction of your total, while in northern climes, it's probably less. Similarly, if you heat with electricity then space heating is likely the biggest bar for you, whereas if you don't, it will be zero.

Still and all, if you start working down the bars in size order and replace anything that is old and inefficient with new and maximally efficient replacements, this will be a fairly rational approach.

Monday, 3 December 2012

Top Home Electricity Users

Doha Climate Talks Enter Week 2

THE world is on track to see "an unrecognisable planet" that is between 4 and 6 degrees hotter by the end of this century, according to new data on greenhouse gas emissions.As United Nations climate negotiations enter their second week in Doha, Qatar, an Australian-based international research effort that tracks greenhouse gas output will release its annual findings on Monday, showing emissions climbing too quickly to stave off the effects of dangerous climate change.

The new forecast does not include recent revelations about the effects of thawing permafrost, which is starting to release large amounts of methane from the Arctic. This process makes cutting human emissions of fossil fuels even more urgent, scientists say.

The new data from the Global Carbon Project found greenhouse gas emissions are expected to have risen 2.6 per cent by the end of this year, on top of a 3 per cent rise in 2011. Since 1990, the reference year for the Kyoto Protocol, emissions have increased 54 per cent.

It means that the goal of the Doha talks – to hold global temperature rise to 2 degrees – is almost out of reach. That goal requires that emissions peak now and start falling significantly within eight years.

"Unless we change current emissions trends, this year is set to reach 36 billion tonnes of carbon dioxide from the combustion of fossil fuels, we are on the way to an unrecognisable planet of 4 to 6 degrees warmer by the end of this century," said the executive director of the Global Carbon Project, Dr Pep Canadell.

"Unless the negotiators in Doha wake up tomorrow and embrace a new green industrial revolution to rapidly change our energy systems, chances to stay below global warming of 2 degrees Celsius are vanishing very fast, if they are not already gone."

Emissions are growing in line with the most extreme climate models used by the Intergovernmental Panel on Climate Change, according to a paper in the journal Nature Climate Change that explains the Global Carbon Project's findings.

The trajectory means a temperature range of between 3.5 and 6.2 degrees by the year 2100, with a "most likely" range of between 4.2 and 5 degrees. ...

Matthew England, a colleague of Professor Pitman and fellow author of Intergovernmental Panel on Climate Change reports, said: "While the science is clear that emissions reductions are required urgently, each year we are emitting more and more greenhouse gases into the atmosphere. This is like a smoker ramping up the number of cigarettes smoked each day despite grave warnings to stop smoking altogether – sooner or later this catches up with you."

Saturday, 1 December 2012

World Energy Report 2012: The Good, the Bad, and the Really, Truly Ugly

Rarely does the release of a data-driven report on energy trends trigger front-page headlines around the world. That, however, is exactly what happened on November 12th when the prestigious Paris-based International Energy Agency (IEA) released this year’s edition of its World Energy Outlook. In the process, just about everyone missed its real news, which should have set off alarm bells across the planet.Claiming that advances in drilling technology were producing an upsurge in North American energy output, World Energy Outlook predicted that the United States would overtake Saudi Arabia and Russia to become the planet’s leading oil producer by 2020. “North America is at the forefront of a sweeping transformation in oil and gas production that will affect all regions of the world,” declared IEA Executive Director Maria van der Hoeven in a widely quoted statement.

In the U.S., the prediction of imminent supremacy in the oil-output sweepstakes was generally greeted with unabashed jubilation. “This is a remarkable change,” said John Larson of IHS, a corporate research firm. “It’s truly transformative. It’s fundamentally changing the energy outlook for this country.” ...

The editors of the Wall Street Journal were no less ecstatic. In an editorial with the eye-catching headline “Saudi America,” they lauded U.S. energy companies for bringing about a technological revolution, largely based on the utilization of hydraulic fracturing (“fracking”) to extract oil and gas from shale rock. That, they claimed, was what made a new mega-energy boom possible. “This is a real energy revolution,” the Journal noted, “even if it's far from the renewable energy dreamland of so many government subsidies and mandates.”

Other commentaries were similarly focused on the U.S. outpacing Saudi Arabia and Russia, even if some questioned whether the benefits would be as great as advertised or obtainable at an acceptable cost to the environment.

While agreeing that the expected spurt in U.S. production is mostly “good news,” Michael A. Levi of the Council on Foreign Relations warned that gas prices will not drop significantly because oil is a global commodity and those prices are largely set by international market forces. “[T]he U.S. may be slightly more protected, but it doesn’t give you the energy independence some people claim,” he told the New York Times.

Some observers focused on whether increased output and job creation could possibly outweigh the harm that the exploitation of extreme energy resources like fracked oil or Canadian tar sands was sure to do to the environment. Daniel J. Weiss of the Center for American Progress, for example, warned of a growing threat to America’s water supply from poorly regulated fracking operations. “In addition, oil companies want to open up areas off the northern coast of Alaska in the Arctic Ocean, where they are not prepared to address a major oil blowout or spill like we had in the Gulf of Mexico.”

Such a focus certainly offered a timely reminder of how important oil remains to the American economy (and political culture), but it stole attention away from other aspects of the World Energy Report that were, in some cases, downright scary. Its portrait of our global energy future should have dampened enthusiasm everywhere, focusing as it did on an uncertain future energy supply, excessive reliance on fossil fuels, inadequate investment in renewables, and an increasingly hot, erratic, and dangerous climate. Here are some of the most worrisome takeaways from the report.

Given the hullabaloo about rising energy production in the U.S., you would think that the IEA report was loaded with good news about the world’s future oil supply. No such luck. In fact, on a close reading anyone who has the slightest familiarity with world oil dynamics should shudder, as its overall emphasis is on decline and uncertainty.

Take U.S. oil production surpassing Saudi Arabia’s and Russia’s. Sounds great, doesn’t it? Here’s the catch: previous editions of the IEA report and the International Energy Outlook, its equivalent from the U.S. Department of Energy (DoE), rested their claims about a growing future global oil supply on the assumption that those two countries would far surpass U.S. output. Yet the U.S. will pull ahead of them in the 2020s only because, the IEA now asserts, their output is going to fall, not rise as previously assumed.

This is one hidden surprise in the report that’s gone unnoticed. According to the DoE’s 2011 projections, Saudi production was expected to rise to 13.9 million barrels per day in 2025, and Russian output to 12.2 million barrels, jointly providing much of the world’s added petroleum supply; the United States, in this calculation, would reach the 11.7 million barrel mark.

The IEA’s latest revision of those figures suggests that U.S. production will indeed rise, as expected, to about 11 million barrels per day in 2025, but that Saudi output will unexpectedly fall to about 10.6 million barrels and Russian to 9.7 million barrels. The U.S., that is, will essentially become number one by default. At best, then, the global oil supply is not going to grow appreciably -- despite the IEA’s projection of a significant upswing in international demand.

But wait, suggests the IEA, there’s still one wild card hope out there: Iraq. Yes, Iraq. In the belief that the Iraqis will somehow overcome their sectarian differences, attain a high level of internal stability, establish a legal framework for oil production, and secure the necessary investment and technical support, the IEA predicts that its output will jump from 3.4 million barrels per day this year to 8 million barrels in 2035, adding an extra 4.6 million barrels to the global supply. In fact, claims the IEA, this gain would represent half the total increase in world oil production over the next 25 years. ...

Add all this together -- declining output from Russia and Saudi Arabia, continuing strife in Iraq, uncertain results elsewhere -- and you get insufficient oil in the 2020s and 2030s to meet anticipated world demand. From a global warming perspective that may be good news, but economically, without a massive increase in investment in alternate energy sources, the outlook is grim. You don’t know what bad times are until you don’t have enough energy to run the machinery of civilization. As suggested by the IEA, “Much is riding on Iraq’s success... Without this supply growth from Iraq, oil markets would be set for difficult times.”

Friday, 30 November 2012

Staples to off 3D printing in Copy Centers

In a blockbuster announcement, Mcor, the makers of the IRIS color 3D printing system based on plain old paper, say they've struck a huge deal with print services giant Staples to supply 3D printing equipment for their numerous print and copy centers.This will obviously take a while to implement, so Staples Printing Division is starting the process by rolling it out in Belgium and the Netherlands in Q1 2013 and then "will be rolled out quickly to other countries" according to Staples.

How does it work? Those with printable 3D models can merely upload them to Staples' web site, where they will be transformed into full color 3D objects with Mcor's new IRIS paper-based 3D printers. Printed models will be sent to your local Staples or directly to your address. It's not entirely clear from the announcement, but we suspect the 3D printers will not be located initially in all Staples print shops, but instead centralized in some efficient fashion. Nevertheless, we also suspect the long-term intention is indeed to equip every Staples print center with this 3D printing equipment.

The implications of this move are truly enormous, as it will go a very long way to opening up 3D printing for all. Staples is a massive brand with an astonishing capacity for advertising compared to any 3D printing company. Soon people will receive newspaper flyers explaining the new 3D print service. Perhaps we'll even see discount starter promotions. In any case, many more people will know about 3D printing as a result of this deal.

A Mountain Of Debt

Though many Quebecois of the Left would deny it — having hoped for socialism in the ’70s, they see the current muddle as a social apocalypse — a communal commitment to such values has proved surprisingly resilient. Thus it was that the city surprised the world this year, when a series of student protests, ostensibly at an increase in tuition fees, grew far beyond the usual size of the recent Occupy protests, and then engulfed the entire city, drawing mass social sympathy, a march of 500,000 people in a city of 1.5 million, and bringing down the provincial Liberal government in the September elections.In keeping with the city’s retro-modernist character, the protests looked forward from a position that, elsewhere, was far in the past. Quebec’s university system has remained substantially unmolested by the “destructive destruction” visited on it elsewhere, and a francophone sense of education as an essential social good survived. The trigger for the protests was a proposed rise in fees from $2000 per year to $3000 per year, both figures a pittance compared to standard North American fees.

The fees are merely part of a more far-reaching reorganisation of the university system on neoliberal lines, and the protests are at least in part a stand against that. Their size and fervour surprised so many across the world, because we have not seen anything like them for 20, or even 40 years, when the last round of protests at the process failed in their aims in other places.

But the Montreal protests were something else as well — a forward defence against the encroachment of capital’s latest technique for domination: life-long debt. Sure twelve grand for a four-year course isn’t in the league of US universities of equal calibre, where one hundred to two hundred grand must be found, or committed to. But it’s a step on the way, and the Occupy movement and whatever comes out of it is increasingly, and rightly so, focused on this shell game, whereby the general level of minimum qualifications for jobs is remorselessly raised, with no great gain in social return, and a debt-monkey degree becomes essential, simply to compete.

The process not only extends capital into new areas, it makes any discussion of shortening the working day impossible — because millions of people are flat chat under a dual education-mortgage debt burden.

Sunday, 25 November 2012

Energy storage systems signal arrival of ‘baseload’ renewables

It has been widely thought that the arrival of cost-competitive rooftop solar PV systems would be the biggest game changer in the electricity market. But it may be that the emergence of affordable energy storage systems will have an even more profound impact.There are predictions that the energy storage market is going to boom. One survey suggested that $30 billion will be spent on energy storage in the next decade in Australia alone. In the US, where $1 trillion is expected to be spent on electricity network infrastructure in the next 10 years, at least one fifth of that – or $200 billion – will be spent on energy storage.

The big question is who is going to benefit most from that investment – the customer, or the utility that delivers or sells the electricity. Or maybe even both. Most people are still trying to figure that out.

There is little doubt that there is huge interest, and likely huge demand, for the product. Given that the arrival of solar PV has enabled homeowners and small businesses to produce their own energy, it is only natural that they would want to store it.

An analysis by Energeia this year said that as a result of cost reductions in the technology, it predicted there would be 421,000 residential energy storage systems in Australian homes by 2021 – nearly half the number that currently have solar on their rooftops. The new pricing mechanisms that are being introduced into Australia – high rates for peak consumption and low rates for overnight – make it particularly attractive to have both solar, which can draw down cheap energy from the sun during the day, and energy storage – which can store excess energy and draw from the grid at low overnight rates. It effectively doubles the attraction.

Richard Turner, the CEO of Adelaide-based Zen Energy Systems, last month unveiled a new product called Freedom Powerbank, an energy storage system that will allow households to store enough electricity to cater for their average daily usage. An email sent out to 4,000 of Zen’s solar PV customers generated an enormous response – one person a minute signing up for more details, according to Turner. The response from utilities and international customers has been equally effusive, he says.

Turner describes his product as a “world first,” because it uses proprietary software to capture the energy produced by solar, wind, or from the grid, and allows it to be used when the customer chooses. “We have created the most functional energy storage system at one end and at the other end broke through major cost barriers. What we developed is the first battery operating system for renewable energy systems.”

Production of the Freedom Powerbank for households begins in Adelaide in January next year. Turner says the units will cost $29,500 – offering a payback of 7-8 years, but he says the cost will fall as manufacturing techniques improve and some of it is outsourced to cheaper facilities overseas. Larger units will be available for small businesses – who will be able to use the systems to ensure they retain their power sources through any outages – and are being tested by utilities.

Turner says the storage system is a game changer because it is clear that solar PV will be the power supply of the future, and this enables households to store that energy and utilise what is effectively “baseload” renewables.

Saturday, 24 November 2012

Cypherpunks: Freedom and the future of the internet

Cypherpunks are activists who advocate the widespread use of strong cryptography (writing in code) as a route to progressive change. Julian Assange, the editor-in-chief of and visionary behind WikiLeaks, has been a leading voice in the cypherpunk movement since its inception in the 1980s.Now, in what is sure to be a wave-making new book, Assange brings together a small group of cutting-edge thinkers and activists from the front line of the battle for cyber-space to discuss whether electronic communications will emancipate or enslave us. Among the topics addressed are: Do Facebook and Google constitute "the greatest surveillance machine that ever existed," perpetually tracking our location, our contacts and our lives? Far from being victims of that surveillance, are most of us willing collaborators? Are there legitimate forms of surveillance, for instance in relation to the "Four Horsemen of the Infopocalypse" (money laundering, drugs, terrorism and pornography)? And do we have the ability, through conscious action and technological savvy, to resist this tide and secure a world where freedom is something which the Internet helps bring about?

BHP's Shale PR boom gathers pace

MY TRIP to Texas as a guest of BHP and my subsequent talks in New York with economists, analysts and investment bankers in New York about America's shale oil and gas production boom meanwhile underlined that BHP Billiton got its biggest shale deal in the US right. The growing consensus on Wall Street is also that the US shale boom is a global economic and geopolitical game-changer.BHP's first purchase of shale gas leases in Arkansas for $US4.6 billion was fully valued at the gas price of the day, and the $US2.84 billion write-down the group announced in August was arithmetically generated as US shale gas production soared, and US gas prices plunged.

The group's subsequent $US15 billion takeover of US group Petrohawk at 65 per cent premium to Petrohawk's market price could produce an asset valuation uplift this financial year that more than compensates for the first write-down.

BHP can still earn returns of more than 20 per cent by developing gas wells in Arkansas, but it is aiming instead to increase production of oil and other liquids that are roughly four times more valuable by 15 per cent in 2012-13 by redirecting the vast bulk of its $US4 billion shale capital expenditure budget to Petrohawk's oil and liquids-rich fields in Texas.

In New York, the big bulge-bracket banks are all doing their sums on the shale boom. One estimate of the value transfer from the rest of the world to the US is already $US900 million a day as US domestic production grows and imports fall. That's an amount equal to 2.2 per cent of raw GDP, but what the US does with the income windfall is the key, as it was here during the commodities boom. To the extent that the new income finances consumption of imports, for example, domestic benefits of the boom will be lower.

The US will certainly benefit from cheap domestic gas that will deliver cost benefits to heavy industries including petrochemical plants and power stations, but the horizontal drilling and rock-fracturing technology that is freeing up shale gas and oil will ultimately generate sweeping global changes.

Shale oil can be commercially exploited at oil prices as low as $US80 a barrel, and as shale oil volumes rise, oil price spikes in response to accelerating growth in demand that work to slow demand again will be much less frequent. Shale oil, in other words, is going to raise the maximum speed limit of the global economy. I will have more about the amazing shale boom and BHP's piece of it in coming columns.

Monday, 19 November 2012

Fracking: A new dawn for misplaced optimism

You would think we were swimming in oil. The International Energy Agency's (IEA) latest World Energy Outlook forecasts that the United States will outstrip Saudi Arabia as the world's largest producer by 2017, becoming "all but self-sufficient in net terms" in energy production. While the "peak oil" pessimists are clearly wrong, so is a simplistic picture of fossil fuel abundance.When the IEA predicts an increase in "oil production" from 84 million barrels a day in 2011 to 97 in 2035, it is talking about "natural gas liquids and unconventional sources", which includes a big reliance on "fracking" for shale gas. Conventional oil output will stay largely flat, or fall.

The IEA has been exposed before as having, under US pressure, artificially inflated official reserve figures. And now US energy consultants Ruud Weijermars and Crispian McCredie say there is strong "basis for reasonable doubts about the reliability and durability of US shale gas reserves". The New York Times found that state geologists, industry lawyers and market analysts privately questioned "whether companies are intentionally, and even illegally, overstating the productivity of their wells and the size of their reserves." And former UK chief government scientist Sir David King has concluded that the industry had overstated world oil reserves by about a third. In Nature, he dismissed notions that a shale gas boom would avert an energy crisis, noting that production at wells drops by as much as 90 per cent within the first year.

The rapid decline rates make shale gas distinctly unprofitable. Arthur Berman, a former Amoco petroleum geologist, cites the Eagle Ford shale, Texas, where the decline rate is so high that simply to keep production flat, they will have to drill "almost 1,000 wells" a year, requiring "about $10bn or $12bn a year just to replace supply". In all, "it starts to approach the amount of money needed to bail out the banking industry. Where is that money to come from?"

In September, the leader of the US shale gas revolution, Chesapeake Energy, sold $6.9bn of gas fields and pipelines to stave off collapse. Four months ago Exxon's CEO, Rex Tillerson, told a private meeting: "We're making no money. It's all in the red." The worst-case scenario is that several large oil companies at once face financial distress. Then, says Berman, "you may have a couple of big bankruptcies or takeovers and everybody pulls back, all the money evaporates, all the capital goes away."

Deutsche Bank: Don’t bet on the IEA's prediction of U.S. oil dominance

I usually just write these sort of crazed ramblings off as some sort of PR campaign on behalf of BHP in particular (someone needs to give Marius Kloppers some good press) and the mining and energy industries in general, as they fight the endless battle of capital against labour.

Maybe I'm missing something but from my high level understanding of the US gas industry, the natural gas "cliff" predicted by the likes of Julian Darley never eventuated courtesy of the shale gas boom - however US gas production isn't making new highs (so where is the glut people keep claiming exists ?) - instead the price collapsed due to a combination of manufacturing moving offshore (particularly gas intensive industries like fertiliser and chemicals) and the recession in the US causing demand to slump. Should the US return to growth and industry return based on the lure of cheap gas I think we'll find gas prices climbing rapidly again.

The IEA gave this sort of delusional thinking (US energy independence ahoy !) more momentum recently with the new World Energy Outlook report echoing Citibank's claims earlier this year that the US will soon be the world's leading oil producer (again, thanks to shale oil). Its probably worthwhile remembering that 10 years ago the IEA was claiming global oil production would now be over 100 million barrels per day (currently it stands at 90 million barrels per day, with significant contributions from biofuels and natural gas liquids).

Technology Review has a look at the report - Shale Oil Will Boost U.S. Production, But It Won’t Bring Energy Independence.

The idea that the U.S. could overtake Saudi Arabia, even temporarily, is a stunning development after years of seemingly inexorable declines in domestic oil production. U.S. production had fallen from 10 million barrels a day in the 1980s to 6.9 barrels per day in 2008, even as consumption increased from 15.7 million barrels per day in 1985 to 19.5 million barrels per day in 2008. The IEA estimates that production could reach 11.1 million barrels per day by 2020, almost entirely because of increases in the production of shale oil, which is extracted using the same horizontal drilling and fracking techniques that have flooded the U.S. with cheap natural gas.The Globe and Mail reports that Deutsche Bank analysts aren't convinced by the IEA's predictions for US oil production - Don’t bet on U.S. oil dominance.As of the end of 2011, production had already increased to 8.1 million barrels per day, almost entirely because of shale oil. Production from two major shale resources in the U.S.—the Bakken formation in North Dakota and Montana and the Eagle Ford shale in Texas, now total about 900,000 barrels per day. In comparison, Saudi Arabia is expected to produce 10.6 million barrels per day in 2020.The shale oil resource, however, is limited. The IEA expects production to start gradually declining by the mid-2020s, at which time Saudi Arabia will reclaim the top spot. ...

The other potential issue is whether opposition to fracking in local communities might put the brakes on shale oil development, Sears says. Concerns that fracking will contaminate drinking water have led to objections in some areas, as have concerns that shale oil requires far more drilling wells than conventional oil production. Even if the U.S. is able to quickly develop its shale oil resource, it isn’t likely to be enough to completely eliminate oil imports. The IEA expects that the U.S. will still import 3.4 million barrels per day in 2035. The U.S. consumes nearly 19 million barrels per day, leaving a gap of more than 7 million even at the expected peak in shale oil production in the mid-2020s. However, the IEA expects the gap will be reduced partly by increased use of biofuels and natural gas in transportation, as well as improved vehicle efficiency, which could lower demand for oil.

The IEA does conclude that the United States will nearly be energy self-sufficient by 2035, but that’s after offsetting oil imports with exports of coal and natural gas. To be truly energy independent, the United States would have to invest in technology for converting natural gas and coal into the liquid fuels needed for transportation, or have other technical breakthroughs, such as improved batteries or biofuels, that would quickly reduce the demand for oil.

An influential report arguing that the U.S. will soon become the world’s largest oil producer made a lot of headlines, especially in Canada where the implications are huge.OilPrice.com has an interview with longtime shale gas critic Arthur Berman - Shale Gas Will be the Next Bubble to Pop - An Interview with Arthur Berman.Too bad its findings are wrong, argue the energy analysts at Deutsche Bank.

It’s not that the oil isn’t there, but the conditions needed to develop it are lacking, Deutsche Bank analysts Paul Sankey, David Clark and Silvio Micheloto write in a note entitled ‘Why the U.S. WON"T surpass Saudi Arabia as Number 1 oil producer.’ (The emphasis is the authors’. And if you’re wondering if these guys know what they are talking about, Mr. Sankey has been ranked No. 1 for the last two years by Institutional Investor for coverage of integrated oil companies.)

A combination of U.S. policy restricting exports and sagging domestic U.S. demand for oil products will keep prices soft relative to the rest of the world, making the projects needed to create the huge U.S. supply growth uneconomical, they wrote Thursday in their critique of the report by the International Energy Agency which pointed to a huge shift toward North America in oil production.

“We don’t think the U.S. can become the largest oil producer in the world. Why not? Price, cost and returns. None are really dealt with by the IEA.”

The “shale revolution” has been grabbing a great deal of headlines for some time now. A favourite topic of investors, sector commentators and analysts – many of whom claim we are about to enter a new energy era with cheap and abundant shale gas leading the charge. But on closer examination the incredible claims and figures behind many of the plays just don’t add up. To help us to look past the hype and take a critical look at whether shale really is the golden goose many believe it to be or just another over-hyped bubble that is about to pop, we were fortunate to speak with energy expert Arthur Berman.The Oil Drum also has some cynical words about the potential of shale gas - Tech Talk - Global Oil Supply .Arthur is a geological consultant with thirty-four years of experience in petroleum exploration and production. He is currently consulting for several E&P companies and capital groups in the energy sector. ...

Oilprice.com: How do you see the shale boom impacting U.S. foreign policy?

Arthur Berman: Well, not very much is my simple answer.

A lot of investors from other parts of the world, particularly the oil-rich parts have been making somewhat high-risk investments in the United States for many years and, for a long time, those investments were in real estate.

Now these people have shifted their focus and are putting cash into shale. There are two important things going on here, one is that the capital isn't going to last forever, especially since shale gas is a commercial failure. Shale gas has lost hundreds of billions of dollars and investors will not keep on pumping money into something that doesn’t generate a return.

The second thing that nobody thinks very much about is the decline rates shale reservoirs experience. Well, I've looked at this. The decline rates are incredibly high. In the Eagleford shale, which is supposed to be the mother of all shale oil plays, the annual decline rate is higher than 42%.

They're going to have to drill hundreds, almost 1000 wells in the Eagleford shale, every year, to keep production flat. Just for one play, we're talking about $10 or $12 billion a year just to replace supply. I add all these things up and it starts to approach the amount of money needed to bail out the banking industry. Where is that money going to come from? Do you see what I'm saying?

Oilprice.com: You've been noted suggesting that shale gas will be the next bubble to collapse. How do you think this will occur and what will the effects be?

Arthur Berman: Well, it depends, as with all collapses, on how quickly the collapse occurs. I guess the worst-case scenario would be that several large companies find themselves in financial distress.

Chesapeake Energy recently had a very close call. They had to sell, I don't know how many, billions of dollars worth of assets just to maintain paying their obligations, and that's the kind of scenario I'm talking about. You may have a couple of big bankruptcies or takeovers and everybody pulls back, all the money evaporates, all the capital goes away. That's the worst-case scenario.

Oilprice.com: Energy became a big part of the election race, but what did you make of the energy policies and promises that were being made by both candidates?

Arthur Berman: Mitt Romney, particularly, talked about how the United States would be able to achieve energy independence in five years. Well, that's garbage.

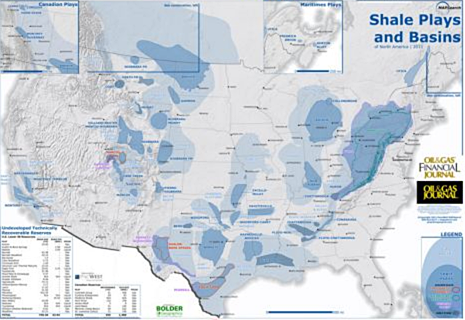

One of the headlines this week from the IEA Report suggests that the United States will be the top global oil producer in five years. Yet back in DeSoto Parish in Louisiana, where the Haynesville Shale discovery in 2008 started the bonanza, revenues are now falling and school board budgets are strapped as the end of the glory days are beginning to appear.Just this week Aubrey McClendon said that Chesapeake’s prospects for oil in Ohio, where Chesapeake had high hopes for the Utica Shale, are now dim. It is easy to look at one of the large maps showing all the shale deposits in the United States that the Oil and Gas Journal include in their print editions, and to be carried away (as the IEA apparently are) with the vast acreage that is shaded on the map. Unfortunately, as we can see, reality tells another story. The size of the resources have been measured in the past, and with the best plays being given preference, the recognition of decline rates and unprofitable wells have not yet been given the prominence in the popular press that they will ultimately draw.

It seems unrealistic to anticipate the levels now being projected for future North American production of oil. Nevertheless, these projections do tend to crowd conflicting stories on the subject out of the spotlight. Further, if the predictions for American production gains, even in the short term, turn out to be optimistic, then the impacts may be even more exaggerated than is currently appreciated. Consider that OPEC now expects that North America will continue to provide the greatest y-o-y increase in supply over other nations, and there are in fact, few other nations that will contribute much more in the next year.

I am less persuaded myself that using a thousand oil rigs to generate an extra one million barrels per day of oil is necessarily a sign of a large and long-term sustainable increase in US oil production (as opposed to, say, frenzied scraping of the bottom of the barrel). But, still, I'm not certain beyond a reasonable doubt just how deep this particular barrel can be scraped.At any rate, one thing that is interesting is that the chart above shows the US second peak just reaching 10mbd of oil, and yet the US will be the largest producer of oil. Since the IEA says Saudi production is currently at 9.5mbd and Russia at 10.75mbd, the implication is that neither Russia or Saudi Arabian production will increase at all between now and 2020 when the US will surpass them.

Apparently, the strategy of massed hordes of drilling rigs fracking for shale oil can only be of benefit in the United States.

It used to be Saudi Arabia that was used to fill in the wedge between desired supply and expected demand in official energy projections. Apparently the agencies have now accepted that Saudi Arabia cannot or will not increase production and the US is now being assigned the role of supplier of last resort for future energy projections.

Gas industry rattled by findings of triple normal levels of methane emissions

LEVELS of the potent greenhouse gas methane have been recorded at more than three times their normal background levels at coal seam gas fields in Australia, raising questions about the true climate change impact of the booming industry.The findings, which have been submitted both for peer review and to the Federal Department of Climate Change, also raise doubts about how much the export-driven coal seam gas (CSG) industry should pay under the country’s carbon price laws.

Southern Cross University (SCU) researchers Dr Isaac Santos and Dr Damien Maher used a hi-tech measuring device attached to a vehicle to compare levels of methane in the air at different locations in southern Queensland and northern New South Wales. The gas industry was quick to attack their findings and the scientists themselves.

The Queensland government has already approved several major multi-billion dollar CSG projects worth more than $60 billion, all of which are focussed on converting the gas to export-friendly liquefied natural gas (LNG).

More than 30,000 gas wells will be drilled in the state in the coming decades and the industry has estimated between 10 per cent and 40 per cent of the wells will undergo hydraulic fracturing.

The industry and state and federal ministers have claimed that electricity derived from coal seam gas will help slow growth in carbon emissions but, so far, no comprehensive independent lifecycle assessment of emissions has been carried out.

Last August, a Right to Information request submitted by me and reported in the Brisbane Times revealed that the state’s government was prepared to rely on industry-funded research when it came to understanding the industry’s carbon footprint.

A later report from the Australian Petroleum Production and Exploration Association, which looked at emissions from CSG when burned for electricity in China, was produced by Worley Parsons, a company which had won a $580 million contract to work on a major CSG-to-LNG project in the state.

The Federal Energy Minister Martin Ferguson has also waved away suggestions that the government should commission its own independent research into CSG emissions, and was reported as saying such a study was “unnecessary”.

The work at Southern Cross University is arguably the first attempt to independently measure levels of methane coming from gasfield areas.

Dr Santos said in a university release: “The current discussions on CSG are often based on anecdotal evidence, old observations not designed to assess CSG or data obtained overseas. We believe universities are independent institutions that should provide hard data to inform this discussion. The lack of site-specific baseline data is staggering.”

In an interview with the Australian Broadcasting Corporation, Dr Maher said while it was not possible yet to say “definitively” that the raised levels of methane were due to leaks from the CSG facilities, “we have multiple lines of evidence to suggest that that is what is causing it”. He said the initial findings pointed to the CSG operations as a likely source of the raised methane levels – in particular, from “fugitive emissions.

Friday, 16 November 2012

Forbidden City of Oil Platforms: The Rise and Fall of Stalin's Atlantis

In the 1950s, Soviet engineers built a massive city in the Caspian Sea off the coast of Azerbaijan. It was a network of oil platforms linked by hundreds of kilometers of roads and housing 5,000 workers, with a cinema, a park and apartment blocks. Gradually disintegrating but still closely guarded, this astonishing place inspired a fiery scene in a James Bond movie. ...The backdrop of the floating city Bond battled his way out of in the 1999 movie "The World Is Not Enough" was built in Britain's Pinewood Studios -- but it was inspired by a very real location that counts as one the world's most astonishing cities: Neft Dashlari, far out in the Caspian Sea.

This area of Azerbaijan has been famed for its rich oil resources since ancient times. The "liquid fire" with which Constantinople drove the Arab besiegers from its walls in the seventh century consisted largely of oil that bubbled to the surface unaided along the coasts of the Black Sea and the Caspian. The Persians called the area the "Land of Fire," where priests lit their temples with oil from these natural sources.

The petrochemical industry didn't take off here until 1870 after Russia conquered the territory. In the years that followed, industrialists like Ludvig Nobel and the Rothschild brothers transformed the capital Baku into an oriental version of the French Mediterranean jewel of Nice. In 1941, Azerbaijan, then part of the Soviet Union, was already supplying 175 million barrels of crude oil a year -- 75 percent of the country's entire oil production. That's why German forces fought so hard to try to seize the city and the surrounding Absheron Peninsula. They failed.

After the war, Soviet engineers took a closer look at a reef that mariners called the "Black Rock." They built a shed on the tiny island and conducted test drilling. During the night of Nov. 7, 1949, they struck top-quality oil at a depth of 1,100 meters below the seabed and shortly thereafter, the world's first offshore oil platform was built at the spot, now renamed Neft Dashlari, or "oily rock." "Platform" is a hopelessly inadequate word for the many-armed monster of steel and timber that gradually spread across the waves of the sea, which is only 20 meters deep on average, over the following years.

The foundation of the main settlement consists of seven sunken ships including "Zoroaster," the world's first oil tanker, built in Sweden. In Neft Dashlari's heyday, some 2,000 drilling platforms were spread in a 30-kilometer circle, joined by a network of bridge viaducts spanning 300 kilometers. Trucks thundered across the bridges and eight-story apartment blocks were built for the 5,000 workers who sometimes spent weeks on Neft Dashlari. The voyage back to the mainland could take anything between six and twelve hours, depending on the type of ship. The island had its own beverage factory, soccer pitch, library, bakery, laundry, 300-seat cinema, bathhouse, vegetable garden and even a tree-lined park for which the soil was brought from the mainland.

It was a Stalinist utopia for the working class. A Soviet stamp from 1971 summed up the gigantic hopes it embodied in a tiny image: against the black outline of a drilling rig, a road made of bridges snaked its way across the deep blue sea towards further rigs and a red sun on the horizon.

But there are few things as precarious as a world built on water and oil. The collapse of the Soviet Union ushered in the decline of this floating city as new oilfields were discovered elsewhere and the price of oil began to fluctuate. The workforce has halved to 2,500, and most of the rigs are now out of use or can't be reached because the bridges leading to them have collapsed. Of the 300 kilometers of roads, only 45 kilometers remain usable, and even they have fallen into disrepair. During a flood a few years ago, many apartments were submerged up to the second story.

Thursday, 15 November 2012

Powerless: legal heavyweights used to silence farmer

The thing that really irks Bruce Robertson is not just that the giant power companies are threatening to sue him but that their lawyers are demanding he pay for their costs.“It was a service I never requested," quips Robertson, who has had to resort to black humour since the letter from Grid Australia arrived out of the blue last week.

In the quintessential act of corporate bullying, the nation's electricity transmission giants are threatening to sue the corporate-analyst-turned-cattle-farmer from the mid-north coast of NSW.

Robertson has been a constant thorn in their side this year, revealing how the industry's 'gold-plating', dodgy forecasts and misleading rhetoric have been the main factors behind the nose-bleed rise in power bills.

And so Grid Australia, the peak body for the transmission giants, is trying to muzzle him with legal threats.

This story is not just about power companies gagging an outspoken critic. It is about governments too. Grid Australia's members are mostly state-owned power companies. They speak for $10 billion in network assets and they don't like Robertson accusing them of gold-plating one little bit.

Here's the catch. Governments are not allowed to sue their citizens (this is a good thing).

Nor are the other two members of Grid: Victoria's SP-Ausnet, which is controlled by a Singaporean multinational, or South Australia's transmission provider, ElectraNet, which is a consortium of powerful financiers. Both are too big to sue.

Under reforms to the defamation laws seven years ago, big companies are no longer permitted to sue (Section 9 Defamation Act, 2005). The intention of these reforms was precisely to stop this sort of intimidation by large vested interests.

They were designed to prevent large corporations from using the law for commercial purposes – to shut down bad press, among other things....

Departing from the legal aspects for a moment to deliver a layman's observation: Grid Australia is as much of a secret society, controlled by state government agencies, as it is a proper legal entity with a right to sue people for exercising their rights to free speech.

And so we have a front for Transgrid, spending a bundle of taxpayer dollars with a big-city law firm, in an effort to stop a farmer from having his say. And the taxpayers of Victoria and other states are also subsidising this ethically dubious exercise.

Already, Transgrid has spent taxpayer money securing the services of Sue Cato, often regarded as the most expensive crisis management consultant in the market, to assist with its reputational issues. Now it has resorted to lawyers.

BusinessDay has endeavoured for more than a week to contact the Ashurst staff involved in the action. We have also tried the PR department. Despite repeated requests for a response there was none forthcoming.

Randers: What does the world look like in 2052?

What will the world look like in 40 years time. In 2052, will we have enough food and water? Will there be too many people? Will our standard of living be higher. Will we have taken decisive action on climate change.To briefly summarise Jorgen Randers, the renowned Norwegian futurist, the broad answers to those are yes, yes, maybe, no and no. But it’s the way he reaches those conclusions that makes his latest book 2052: A global forecast for the next forty years, so compelling.

Randers made his name as the co-author of the book “The Limits to Growth”, which underpinned the Club of Rome’s work on resource depletion and helped spawn the sustainability movement. Not that he thinks the book and his work had that much impact. “I spent 40 years working on sustainability and failed. The world today is a much less sustainable world,” he lamented during a visit to Australia this week.

Now 67, Randers runs the centre for climate strategy at the Norwegian Business School. And having outlined 12 scenarios for the world running from 1970 to 2100 in his first book, he now feels there is enough information to make more concrete forecasts.

It is not a picture he finds particularly attractive, but one he sees as inevitable because of mankind’s inability to look beyond short-term solutions and the obsession with growth. “I’m not saying what should happen, but this is the sad future that humanity is going to create for itself.”

Here are the base numbers for his predictions. Unlike others that predict a world population of 9 billion in 2050, he sees it peaking at 8 billion in 2040 and then declining, because he says the rich world will choose jobs over children, and the poorer urban families will choose fewer children.

He expects the world economy to grow much slower than most, because it will be harder to increase productivity at the same rate as has occurred in the last four decades. The low hanging fruit in the agricultural, manufacturing and office sectors have been picked. And he does not believe the poor countries will “take off”. He says that by 2050, the world economy will be no more than 2.5 times bigger than it is today, rather than four times bigger as many assume.

The US has a bleak outlook because their average disposable incomes will not grow, because they have already gone further than most in productivity and have a huge debt to China. And, Randers says, because the US is not capable of making simple decisions, it will also be not capable of making difficult decisions. He puts the current debate around climate change, or the lack of it, as an example.

“China is the real winner and they will be 5 times as rich in 40 year time,” Randers says. That’s because of China’s ability to make quick decisions that are in favour of the majority. The rest of the world, he suggests, remains poor,

Still, while the economy and the population will not grow as fast as some predict, and there will be no huge shortage of food, water or energy, it will still grow fast enough to trigger a climate crisis, because the short termism of the political class and business means that greenhouse emissions will not be addressed. He expects emissions will peak between 2030 and 2040, and will have only returned to 2010 levels by 2050 – pushing the world beyond the 2°C scenario and locking in disastrous climate reactions in the second half of the century.

“We will spend more money repairing the damage of climate change after it has occurred instead of spending up front avoiding the climate damage,” he says. “We know what to do. The only reason we do not do it is because it is slightly more expensive than doing nothing, so we don’t do it. It is very frustrating.”

Sunday, 14 October 2012

Oil vs Tomatoes: Basra’s Farmers Continue To Protest

Basra’s farmers say the oil industry is “occupying” their land – and that the one thing the Iraqi government is forgetting in its race to get oil firms in and farmers out, is the rising cost of the food Iraq can no longer grow itself.Just over a year ago, Saleh Mohammed was farming in the Qurna area, west of the southern Iraqi city of Basra. But then the oil companies came. And today the land that Mohammed once farmed belongs to international oil giant, Exxon Mobil. And Mohammed himself works as an employee on the periphery of one of the oil production facilities. Mohammed is 30 and his field of expertise is agriculture; he knows the ways of nature.

He worked on his 2.5 hectare property planting wheat, barley and dates and everything he knew, he learned from his parents and grandparents, who had farmed the land before him. He really doesn’t know much about the oil industry. Yet, like so many others here, he too now wears the grey overalls and cap of oil facility workers.

“When the American, Russian and British oil companies started to come here, the government just wanted us to disappear,” Mohammed says. “They even offered us financial compensation to do so. Now some of us work as watchmen, some of us as gardeners and some as labourers with the oil companies for around US$600 a month. And I didn’t really have a choice in this matter – I have a wife and four children to look after.”

Mohammed is not alone. It’s estimated that there are 43 billion barrels of oil under the ground in this region. Almost all of Iraq’s oil currently comes from here. All of which clearly means big business, not only for the oil companies, but also for the Iraqi government.

Oil Espionage: Traders Spy on Oklahoma Hub With Satellites, Sensors and Infrared Cameras

The bottleneck of crude stored in Cushing, Okla., has become the country’s “biggest bank vault of oil,” Businessweek’s Matthew Phillips writes. And it’s only getting bigger.The clog — which is pushing down the price of West Texas Intermediate crude from Oklahoma, creating a gap with its international rival, Brent — is making traders rich.

Information is everything, and traders are using high-tech extremes to extract data about oil storage and flow from the high-security oil hub. Photographers in helicopters? That’s relatively low-level when it comes to these storage tank spy games, Businessweek reports:

Recently, photographers have started using infrared cameras to peer inside the tanks. The difference in heat can often show where the oil line is.Aerial photography is common. A bird’s-eye view allows analysts to estimate storage levels by calculating the angle of shadows cast by massive tanks’ floating roofs.And that’s just the beginning.

A private “energy intelligence” company called Genscape is funding much of the high-tech surveillance, reports Businessweek, whose parent company — Bloomberg — also does their own Cushing surveillance by way of twice-weekly satellite flyovers.

3-D Printer Company Seizes Machine From Desktop Gunsmith

Cody Wilson planned in the coming weeks to make and test a 3-D printed pistol. Now those plans have been put on hold as desktop-manufacturing company Stratasys pulled the lease on a printer rented out for Wiki Weapon, the internet project lead by Wilson and dedicated to sharing open-source blueprints for 3-D printed guns. Stratasys even sent a team to seize the printer from Wilson’s home.“They came for it straight up,” Cody Wilson, director of Defense Distributed, the online collective that oversees the Wiki project, tells Danger Room. “I didn’t even have it out of the box.” Wilson, who is a second-year law student at the University of Texas at Austin, had leased the printer earlier in September after his group raised $20,000 online. As well as using the funds to build a pistol, the Wiki Weapon project aimed to eventually provide a platform for anyone to share 3-D weapons schematics online. Eventually, the group hoped, anyone could download the open source blueprints and build weapons at home.

Until Stratasys pulled the lease, the Wiki Weapon project intended to make a fully 3-D printed pistol for the first time, though it would likely be capable of only firing a single shot until the barrel melted. Still, that would go further than the partly plastic AR-15 rifle produced by blogger and gunsmith Michael Guslick. Also known as “Have Blue,” Guslick became an online sensation after he made a working rifle by printing a lower receiver and combining it with off-the-shelf metal parts.

But last Wednesday, less than a week after receiving the printer, Wilson received an e-mail from Stratasys: The company wanted its printer returned. Wilson wrote back, and said he believed using the printer to manufacture a firearm would not break federal laws regarding at-home weapons manufacturing. For one, the gun wouldn’t be for sale. Wilson added that he didn’t have a firearms manufacturers license.

Friday, 12 October 2012

Liquid air 'offers energy storage hope'

Turning air into liquid may offer a solution to one of the great challenges in engineering - how to store energy.The Institution of Mechanical Engineers says liquid air can compete with batteries and hydrogen to store excess energy generated from renewables.

IMechE says "wrong-time" electricity generated by wind farms at night can be used to chill air to a cryogenic state at a distant location. When demand increases, the air can be warmed to drive a turbine.

Engineers say the process to produce "right-time" electricity can achieve an efficiency of up to 70%. ...

The technology was originally developed by Peter Dearman, a garage inventor in Hertfordshire, to power vehicles.

A new firm, Highview Power Storage, was created to transfer Mr Dearman's technology to a system that can store energy to be used on the power grid. The process, part-funded by the government, has now been trialled for two years at the back of a power station in Slough, Buckinghamshire. ...

IMechE says the simplicity and elegance of the Highview process is appealing, especially as it addresses not just the problem of storage but also the separate problem of waste industrial heat.

The process follows a number of stages:

*"Wrong-time electricity" is used to take in air, remove the CO2 and water vapour (these would freeze otherwise)

* the remaining air, mostly nitrogen, is chilled to -190C (-310F) and turns to liquid (changing the state of the air from gas to liquid is what stores the energy) the liquid air is held in a giant vacuum flask until it is needed

* when demand for power rises, the liquid is warmed to ambient temperature. As it vaporizes, it drives a turbine to produce electricity - no combustion is involvedIMechE says this process is only 25% efficient but it is massively improved by co-siting the cryo-generator next to an industrial plant or power station producing low-grade heat that is currently vented and being released into the atmosphere. The heat can be used to boost the thermal expansion of the liquid air.

More energy is saved by taking the waste cool air when the air has finished chilling, and passing it through three tanks containing gravel. The chilled gravel stores the coolness until it is needed to restart the air-chilling process.

Thursday, 11 October 2012

The Empire Strikes Back ? Gross Feed In Tariffs

It the solar industry ever harboured any illusions about the challenges it is facing in imposing itself on a sector that has been virtually unchallenged for more than half a century, then they were certainly shattered by a series of attacks on their industry from utilities and pricing regulators over the last few weeks.Giles has a follow up article noting that the gross proposal has been abandoned, for now - Utilities say no to gross tariffs, yes to battery storage.It is now clear – if it wasn’t before – that Australian energy utilities are moving decisively against the proliferation of solar PV in an attempt to protect their revenues and business models, as we predicted they would back in June. This is the claim of the solar industry, and they point to numerous examples of tariff changes, network impediments and the lobbying and influence over regulators.

Last week’s revelation that the Queensland pricing regulator was contemplating a tariff that could effectively kill the attraction of solar PV to households struggling under the weight of rising prices from the grid, was proof enough. The attempt by TRUenergy to bring a halt to the deployment of both wind and solar – citing the potential of both to cripple the conventional energy industry – is a further sign of the desperation of those utilities struggling to adapt.

There is no doubt that the debate over clean energy has moved beyond day to day concerns around climate change (even if it should not), and now that technologies such as solar can deliver electricity at equal or lower prices at the socket, the issue of technology cost is also nearly redundant. The battleground has moved to regulation, and policy decisions on the framing of tariffs and how to reflect the true value of producing and consuming energy. And it’s largely played out out of the public eye.

What is required is a new way of looking at the energy system. The hub-and-spoke model, like fixed-line telephony, is creaking under the strain of the so-called “self consumption” market and the ability of customers to produce their own energy.

And the regulation has gotten off to a bad start. The premium tariffs designed to give rooftop solar a kick-start and help reduce its “soft costs” – those for installing, pricing and maintaining the systems – were so badly managed in some key states (NSW, in particular), that utilities seeking to defend their territory and business models were able to gain the moral high ground and win favourable tariff structures under the lofty goal of protecting disadvantaged consumers.

Most tariffs in the country are now structured around a net tariff, which enables a household to use the electrons they produce to offset their consumption and rising retail prices from the main utilities. But any excess production is sold back at a peppercorn rate (under the guise of network and other costs) to the retailers, who then sell it to a nearby customer for between two and four times as much.

However, the utilities have been quietly pushing for an even more draconian measure to be introduced – a gross tariff, which will require households to sell all their output to the retailer and then buy it back at an inflated price.

In a nod to the emerging power of the “pro-sumer”, Australian energy network operators and retailers have rejected a suggestion to move to gross tariffs for rooftop solar, saying it risked turning customers against them. Some suggest tariffs that would encourage homeowners to invest in more battery storage.Operators of electricity networks in Queensland and the energy retailers have overwhelmingly rejected a proposal by the state’s competition authority to introduce gross tariffs for rooftop solar, saying they would be complex, expensive and unfair to owners of rooftop panels.

The Queensland Competition Authority raised some eyebrows, and a few hackles, last month when it raised the prospect of a gross tariff in an issues paper it prepared for deliberations around a “fair and reasonable” tariff for solar.

The solar industry immediately condemned the proposal, saying the idea of forcing customers to sell all their solar power to retailers and then buy it back at a much higher price was inequitable and would effectively mean the death of the industry, as it would remove the attraction of rooftop systems as a hedge against rising electricity costs. And it seems that the utilities, who were suspected by some, of quietly advocating the move, have recognized the risk of putting consumers offside if such a tariff was introduced.

Most of the submissions put to the QCA by network operators and retailers pointed to the potential complexity and cost of a gross tariff – particularly in having to change metering arrangements.

Interestingly, it was TRUenergy, under fire over its proposal to sharply reduce the development of utility scale wind and solar developments by curtailing the ambition of the renewable energy target, which said most clearly that gross FITs were unfair because they were not equitable to consumers.

It noted that households that invested in rooftop photovoltaic systems do so in the expectation that they will be able to consume less grid energy, and thereby gain a sense of control over their costs.

“Under the proposed changes, households would be required to ‘sell’ energy to the grid at the cost of energy, and then ‘purchase’ energy for their own use, at up to three times the price,” it noted in its submission. It said it would be confusing and “may create the perception that electricity retailers are benefiting at the consumer’s expense.”

Wednesday, 10 October 2012

RIP Alan Jones ?

This time round Jones' comments about the death of the Prime Minister's father managed to annoy enough people that there was a concerted effort led by various Facebook and Twitter users (in particular Sack Alan Jones and Destroy The Joint) to tell advertisers to either cease supporting his program or find themselves doing a lot of damage to their brands, with most of them promptly abandoning Jones to his fate and the program subsequently going advertisement free.

Alan Kohler at the BS has a good summary - Alan Jones: it’s about disintermediation.

Corporate leaders everywhere would be watching the predicament of Russell Tate and Robert Loewenthal, chairman and CEO of Macquarie Radio Network, with a mixture of fascination and horror.The SMH reports that Tony Abbott's replacement in waiting Malcolm Turnbull was happy to see Jones get a taste of his own medicine - Jones has not been bullied - Turnbull.A social media campaign against one their products, the Alan Jones breakfast programme, and directed at their business customers as well as their own company, has forced them to cancel all advertising on that show.

For those who have recently flown in from Mars, it started with a speech by broadcaster Alan Jones to the Sydney University Liberal Club dinner on September 22nd, eventually reported in the Sunday Telegraph, in which he said: “They [Labor] are indeterminate and compulsive liars. They’ll lie and lie and lie. Every person in the caucus of the Labor party knows that Julia Gillard is a liar. Everybody, I’ll come to that in a moment. The old man recently died a few weeks ago of shame. To think that he had a daughter who told lies every time she stood for parliament.”

The suggestion that John Gillard died of shame has been widely and appropriately condemned, and Jones himself called a press conference last week to (sort of) apologise. Meanwhile 70 companies withdrew their advertising from his programme, either because they didn’t like what he said or because their social media monitoring services had picked up that their own customers didn’t like it.

Yesterday Russell Tate issued a long statement in which he announced the temporary suspension of all advertising in its Breakfast Show, blaming “21st century censorship, via cyber bullying”.

Also, the MC for the evening on September 22nd, Simon Berger lost his job as public relations and government relations manager at Woolworths, having apparently worn a chaff bag onstage to introduce Alan Jones (a reference to Jones’ frequent calls for Julia Gillard to be put in a chaff bag and thrown out to sea).

The “Sack Alan Jones” Facebook page has 15,486 “likes”, which doesn’t seem that many to have caused such carnage, but there has been a lot more to it than that.

There’s a petition on change.org with 109,962 signatories, another Facebook community called “Destroy The Joint”, after a statement by Alan Jones that women are “destroying the joint”, plus an uncountable number of tweets and hashtags on Twitter.

Russell Tate was both right and wrong in the statement that I quoted above: it is, indeed, 21st century censorship, but to call it bullying misses the point.

The digital revolution is only just getting going, and the social platforms, Twitter and Facebook, which has just passed a billion users, are only just starting to flex their muscle. There is a long way to go with this. Censorship up to the end of the 20th century involved community representatives – the church and then politicians – imposing limits on free speech. With social media, the community does it more directly and much more uncontrollably. ...

The essence of change that occurred between the 20th and 21st centuries is disintermediation. It is happening much more broadly than in censorship, but in that field of human endeavour, as it is everywhere, social media and the digital revolution generally, is simply and powerfully removing the intermediaries.

The organisation and expression of community disapproval has become incredibly powerful because it is spontaneous, immediate and clearly authentic.

That’s the difference between a social media campaign and a rap on the knuckles by the Australian Communication and Media Authority, the media regulator: you can argue about whether ACMA truly represents community opinion; with Facebook and Twitter you can actually see and feel it.

ALAN JONES has been ''given a dose of his own medicine'' with the online campaign that has stripped his station of sponsors, and is not the victim of ''cyberbullying'' as he has claimed, the Coalition communication spokesman, Malcolm Turnbull, has said. ...The SMH had an earlier article from Peter Fitzsimmons describing the origin of the boycott campaign - Alan Jones has no shame.''Mr Jones has sought to lead 'people's revolts' for many years. But this was indeed a popular revolt against vicious and destructive public discourse … It is difficult not to believe that he is getting a dose of his own medicine …

''Mr Jones has complained that he has been the victim of social media bullying, saying that if it happened anywhere else in society, this kind of bullying or harassment or intimidation or threatening conduct, the police would be called in …

''But Mr Jones believes his association with certain products will encourage people to buy them … If other people take the view that an association with Mr Jones will lead them not to buy those products, why are they not able to tell the advertiser of their view and encourage others to do the same?''

Every time you think 2GB broadcaster Alan Jones has gone as low as he can go, he sets a new benchmark ever deeper in his now obviously bottomless barrel.Not enough that he has already talked of putting the Prime Minister “into a chaff bag and hoisting her into the Tasman Sea,” or that he has said that the country needs to “bring back the guillotine,” to deal with her, and that across the country “women are wrecking the joint". Now, before an audience of Sydney University Young Liberals last weekend at the Watermark Restaurant at Balmoral he has referred to the grieving PM's late father, John Gillard – a man who was obviously very close to, and extremely proud, of his daughter – and said that he, “died a few weeks ago of shame".

The unspeakably vicious nastiness of it, the sheer bully-boy misogyny of saying such a thing, simply takes the breath away, even for those of us who spent fair chunks of time around the unvarnished Jones.

Guerilla Grafters

All Tara Hui wanted to do was plant some pears and plums and cherries for the residents of her sunny, working-class neighborhood, a place with no grocery stores and limited access to fresh produce.But officials in this arboreally challenged city, which rose from beneath a blanket of sand dunes, don't allow fruit trees along San Francisco's sidewalks, fearing the mess, the rodents and the lawsuits that might follow.

So when a nonprofit planted a purple-leaf plum in front of Hui's Visitacion Valley bungalow 31/2 years ago — all flowers and no fruit, so it was on San Francisco's list of sanctioned species — the soft-spoken 41-year-old got out her grafting knife.

"I tried to advocate for planting productive trees, making my neighborhood useful, so people could have free access to at least fruit," she said. "I just wasn't getting anywhere."

Today, Hui is the force behind Guerrilla Grafters, a renegade band of idealistic produce lovers who attach fruit-growing branches to public trees in Bay Area cities (they are loath to specify exactly where for fear of reprisal).

Their handiwork currently is getting recognition in the 13th International Architecture Biennale in Venice, Italy, as part of the U.S. exhibit called "Spontaneous Interventions: Design Actions for the Common Good." Closer to home, however, municipal officials have denounced the group's efforts.

Even the urban agriculture movement is torn when it comes to the secretive splicers, outliers in a nascent push to bring orchards to America's inner cities. While many applaud their civil disobedience, others fear a backlash against community farming efforts. And few believe their work will ever fill a fruit bowl.

Not that that really matters.

"It's like the gardener's version of graffiti," said Claire Napawan, assistant professor of landscape architecture at UC Davis and a grafters sympathizer. "Even if there's some question about its ability to produce enough food to make a difference … as an awareness piece, it's a good idea."

Friday, 28 September 2012

Tinfoil Humour

And yet you’d need to be wearing a tinfoil hat to believe there’s anything to chemtrails…

Thursday, 27 September 2012

How High Oil Prices Will Permanently Cap Economic Growth

For most of the last century, cheap oil powered global economic growth. But in the last decade, the price of oil has quadrupled, and that shift will permanently shackle the growth potential of the world’s economies.The countries guzzling the most oil are taking the biggest hits to potential economic growth. That’s sobering news for the U.S., which consumes almost a fifth of the oil used in the world every day. Not long ago, when oil was $20 a barrel, the U.S. was the locomotive of global economic growth; the federal government was running budget surpluses; the jobless rate at the beginning of the last decade was at a 40-year low. Now, growth is stalled, the deficit is more than $1 trillion and almost 13 million Americans are unemployed.

And the U.S. isn’t the only country getting squeezed. From Europe to Japan, governments are struggling to restore growth. But the economic remedies being used are doing more harm than good, based as they are on a fundamental belief that economic growth can return to its former strength. Central bankers and policy makers have failed to fully recognize the suffocating impact of $100-a-barrel oil.

Running huge budget deficits and keeping borrowing costs at record lows are only compounding current problems. These policies cannot be long-term substitutes for cheap oil because an economy can’t grow if it can no longer afford to burn the fuel on which it runs. The end of growth means governments will need to radically change how economies are managed. Fiscal and monetary policies need to be recalibrated to account for slower potential growth rates.

Wednesday, 26 September 2012

A 3D Printer That Uses Bioplastic

Dutch architecture firm DUS has developed The KamerMaker (RoomBuilder) – a 3D printer so large that it can create entire rooms! Dubbed by its creators the “world’s first movable pavilion,” the KamerMaker features an enlarged ‘Ultimaker’ 3D printing machine that is so big it’s actually capable of printing smaller pavilions. In fact, it is capable of printing objects as large as 7.2 feet by 7.2 feet by 11.4 feet. Not only that, but the large-scale 3D printer can produce objects made from corn bio-plastic.

UK overseas gas imports to surge to $11 billion by 2015

Britain's natural gas imports from outside the North Sea will surpass domestic production by 2015 and add more than $11 billion to import costs as domestic supplies dwindle and Norway increasingly struggles to fill the gap, Reuters research shows.Estimates show that Britain's own gas supplies will fall from around 43 billion cubic metres (bcm) per year today to around 16 bcm in 2030 if they continue their average annual 5 percent decline since peaking in 2000, while demand is set to hold steady between 85 and 95 bcm.

Britain was a net exporter of gas until 2004, but a steady decline in output over the last few years has made it more reliant on imports, which have so far mostly come from Norway and, increasingly, Qatar.

South Korea Plans 200-Megawatt Tidal-Power Plant by 2016

South Korea plans to build a tidal- energy plant on the southern tip of the peninsula by 2016, saving an estimated 330,000 metric tons of greenhouse gas emissions a year.South Jeolla province signed an initial agreement with Korea Electric Power Corp. (KEP), Korea Midland Power Co. and five other companies to build the 200-megawatt plant in Jindo, the provincial government said in an e-mailed statement without giving cost estimates.

A Melting Greenland Weighs Perils Against Potential

As icebergs in the Kayak Harbor pop and hiss while melting away, this remote Arctic town and its culture are also disappearing in a changing climate.Reuters is quoting an FT interview with Total's chief saying that oil extraction in Greenland is a bad idea - Total chief warns against Arctic drilling: FTNarsaq’s largest employer, a shrimp factory, closed a few years ago after the crustaceans fled north to cooler water. Where once there were eight commercial fishing vessels, there is now one.

As a result, the population here, one of southern Greenland’s major towns, has been halved to 1,500 in just a decade. Suicides are up.

“Fishing is the heart of this town,” said Hans Kaspersen, 63, a fisherman. “Lots of people have lost their livelihoods.”

But even as warming temperatures are upending traditional Greenlandic life, they are also offering up intriguing new opportunities for this state of 57,000 — perhaps nowhere more so than here in Narsaq.

Vast new deposits of minerals and gems are being discovered as Greenland’s massive ice cap recedes, forming the basis of a potentially lucrative mining industry.

One of the world’s largest deposits of rare earth metals — essential for manufacturing cellphones, wind turbines and electric cars — sits just outside Narsaq.

This could be momentous for Greenland, which has long relied on half a billion dollars a year in welfare payments from Denmark, its parent state. Mining profits could help Greenland become economically self sufficient, and may someday even render it the first sovereign nation created by global warming.

“One of our goals is to obtain independence,” said Vittus Qujaukitsoq, a prominent labor union leader.

But the rapid transition from a society of individual fishermen and hunters to an economy supported by corporate mining raises difficult questions. How would Greenland’s insular settlements tolerate an influx of thousands of Polish or Chinese construction workers, as has been proposed? Will mining despoil a natural environment essential to Greenland’s national identity — the whales and seals, the silent icy fjords, and mythic polar bears? Can fishermen reinvent themselves as miners?

“I think mining will be the future, but this is a difficult phase,” said Jens B. Frederiksen, Greenland’s housing and infrastructure minister and a deputy premier. “It’s a plan that not everyone wants. It’s about traditions, the freedom of a boat, family professions.”

The Arctic is warming even faster than other parts of the planet, and the rapidly melting ice is causing alarm among scientists about sea-level rise. In northeastern Greenland, average yearly temperature have risen 4.5 degrees in the past 15 years, and scientists predict the area could warm by 14 to 21 degrees by the end of the century.

Energy companies should not drill for crude oil in Arctic waters because the environmental risks are too high, Total SA Chief Executive Officer Christophe de Margerie said in the Financial Times on Wednesday. The newspaper described de Margerie's comments as the first time a major oil company has publicly criticised offshore exploration in the Arctic.The risk of an oil spill in such an environmentally sensitive area was simply too high, according to de Margerie. "Oil on Greenland would be a disaster. A leak would do too much damage to the image of the company," he said.

Street Pump Sighting In Surry Hills