Australian mining giant BHP has lost a quarter of its former market capitalization since its acquisition of US shale acreage from Petrohawk and Chesapeake last year. The company is keen to point out that worldwide economic conditions have impacted the price and volume of the commodities that BHP extracts and sells on a global basis. BHP’s US shale gas assets are part of its declining performance. Having paid a whopping $19bn for the shale plays in 2011, BHP now faces serious write downs. Ruud Weijermars and Matthew Hulbert ask the serious question whether the lost value simply is a result of changed market conditions - or was the acreage already worth much less at the actual time of its purchase by BHP?BHP management concedes it is currently assessing the near-term gas price effect on the value of its gas properties acquired last year from Chesapeake (CHK) and Petrohawk (HK). To many industry analysts this is no surprise; the economic fundamentals of US shale gas production and reserves were already questioned long before the BHP sales went through. Petrohawk had never managed to earn any operational profit from its shale gas assets over its 15 years of operations. HK sold gas below the full-cycle production cost and its accumulated losses amounted to some $1 billion when the company was bailed out by BHP last year.

In short, Petrohawk was a ‘precursor’ to Chesapeake’s recently publicized cash-flow crunch predicament. The lack of access to financing, combined with overleveraged debt and lack of operational earnings from gas wells meant one thing: sell assets quickly. One can confidently conclude that HK shareholders were remarkably lucky to receive a very handsome price – twice the market value - for their distressed gas assets in June 2011.

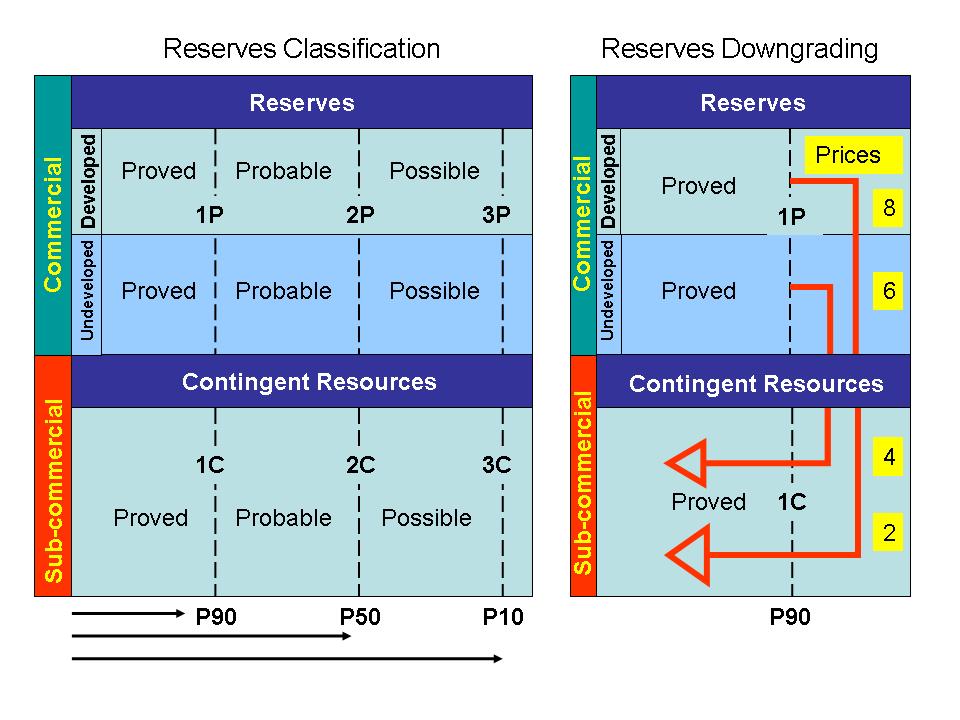

In our opinion, a significant portion of HK’s formerly ‘approved’ gas reserves more likely than not was overdue for downgrading to ‘contingent’ resources by the time of their sale to BHP. In ball park terms, that’s the difference between gas assets that can be produced commercially at current prices, and those which can’t ...

The core of the problem with shale acreage valuation is that the net present value of gas reserves has become as volatile as the gas price itself. But companies have been slow in exercising due diligence if not outright reluctant to depreciate assets. In spite of the low gas prices in 2009, 2010 and 2011, companies like Chesapeake and Petrohawk continued to aggressively book proved undeveloped reserves (PUDs). Both Petrohawk and Chesapeake needed these new reserves on their balance sheets - without these reserve additions, they would have landed into collateral default. And although SEC rules mandate companies must duly impair PUDs when overall project cost have become uneconomic, PUDs now account for nearly half of CHK’s (and former HK’s) proved reserves. Chesapeake’s reported proved reserves comprised 42% PUDs in 2009, and the proportion grew to 47% in 2010, and settled at 46% in 2011.

Oddly enough, once a company has sunken the cost for well development of a PUD, the developed proved reserves need only be impaired if the annual cash flow turns negative, which would require gas sales to dip below operating expenses. In the well’s subsequent life-cycle, SEC rules leave room for continued classification of a well’s resources as reserves, as long as annualized cash flows remain positive. This encouraged companies to continue quickly sinking cost in wells that may not, in fact, ever have been economic (on a full cost basis) in the first place. By doing so, companies quickly 'prove' the reserves of a new shale gas play, and the acreage value rises. This also means that many US shale gas companies have essentially ignored full cycle economics. The sunk cost game continues even today.

Investors still appear prepared to bear the cost, but may not be fully aware of the additional risk.

With gas prices plummeting, the SECs former ’premium label’ of proved reserves has lost its stable foundation. In fact, full cycle economics for the majority of US shale gas plays has been largely negative for the past four years. The SEC has been lenient and one might speculate that overly aggressive reserve reporting appeared an affordable governance risk for shale gas operators. There has been no favourable gas price for adding proved reserves, yet unconventional gas companies have booked reserves by operating aggressively on a sunk cost basis. As a result, US shale gas investments have now become less secure than the reported reserves suggest – something investors seem to haven glossed over far too lightly.

Monday, 27 August 2012

Shale Gas Assets - Overpriced Or a Liquid Turn for Mining Giant BHP?

Posted on 03:34 by Unknown

The Oil Drum has a look at BHP's expensive foray into North American shale gas production - Shale Gas Assets - Overpriced Or a Liquid Turn for Mining Giant BHP?.

Subscribe to:

Post Comments (Atom)

0 comments:

Post a Comment